Joint names policy

Contents |

[edit] Overview

A joint names policy is type of insurance often required by construction contracts. The policy is typically held jointly by the employer and the contractor, although other parties such as funders may also wish to be included. The key feature of this type of policy is that the insured parties are unable to claim against one another in respect of an insured loss, as they are considered to be one-and-the-same for the purposes of the insurance.

This has a number of advantages. Firstly, it means that neither party needs to take out its own insurance policy, which can lead to dual insurance, unnecessarily increasing the project’s total insurance cost. Secondly, it can help avoid costly litigation between the jointly-insured parties who may otherwise try to claim against the other. In addition, the policy cannot be cancelled without both the parties being aware of this.

The insurer has no rights of subrogation, meaning that they cannot recover amounts paid to one of the insured by pursuing the other.

Joint names contractor’s all-risks insurance is particularly common, (sometimes referred to as 'contract works insurance') and covers all risks normally associated with a construction project.

Joint names policies are also common on building contracts involving renovations and extensions, where it is normally taken out by the property owner/employer and building contractor. Typically this covers both the existing structure and the works themselves, and means the property owner/employer is entitled to the proceeds of a claim made under the cover, which they would not be entitled to if the works cover were in the contractor’s name alone. This helps protect them against the potential insolvency of the contractor, or problems claiming disputed amounts.

[edit] Tyco v Rolls Royce

In the case of Tyco v Rolls Royce, a fire protection scheme, designed and installed by the claimant, leaked and damaged parts of the building that were separate from the works. Before beginning the work, the claimant had agreed to indemnify the defendant against damage that may result from their negligence, and the defendant was required to maintain joint names insurance in respect of ‘specified perils’.

The defendant claimed damages to which the claimant argued it could not be held liable, as the contract had required a joint names policy which the defendant had failed to take out. They argued that had the defendant taken out the policy, they would have been able to claim damages from the insurer.

The court initially ruled that the claimant could not be liable because the defendant had failed to take out the appropriate insurance as specified by the contractual scheme adopted by both parties.

However, the Court of Appeal overturned this ruling, finding that the contract only referred to a joint names policy with ‘others’, including ‘contractors’ and that this did not specifically identify Tyco. In any event, joint names insurance would not necessarily have prevented a subrogated action against the contractor. This would only have been prevented by express terms in the policy prohibiting it.

[edit] Find out more

[edit] Related articles on Designing Buildings Wiki:

- Contract works insurance.

- Design liability.

- Directors and officers insurance.

- Excepted risk.

- Flood insurance.

- Insurance.

- JCT Clause 6.5.1 Insurance.

- Latent defects insurance.

- Legal indemnities.

- Professional Indemnity Insurance.

- Specified perils in construction contracts.

- Sub-contract.

[edit] External references

- JCT Insurance - Joint names insurance

- Mondaq - Joint names insurance and risk allocation in construction projects

Featured articles and news

Latest Build UK Building Safety Regime explainer published

Key elements in one short, now updated document.

UKGBC launch the UK Climate Resilience Roadmap

First guidance of its kind on direct climate impacts for the built environment and how it can adapt.

CLC Health, Safety and Wellbeing Strategy 2025

Launched by the Minister for Industry to look at fatalities on site, improving mental health and other issues.

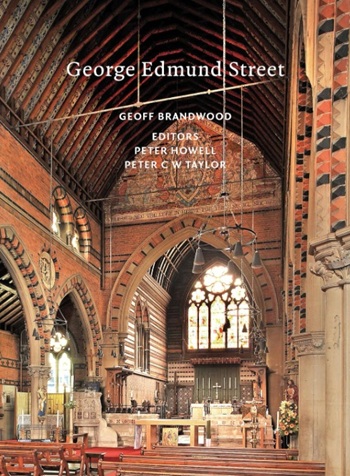

One of the most impressive Victorian architects. Book review.

Common Assessment Standard now with building safety

New CAS update now includes mandatory building safety questions.

RTPI leader to become new CIOB Chief Executive Officer

Dr Victoria Hills MRTPI, FICE to take over after Caroline Gumble’s departure.

Social and affordable housing, a long term plan for delivery

The “Delivering a Decade of Renewal for Social and Affordable Housing” strategy sets out future path.

A change to adoptive architecture

Effects of global weather warming on architectural detailing, material choice and human interaction.

The proposed publicly owned and backed subsidiary of Homes England, to facilitate new homes.

How big is the problem and what can we do to mitigate the effects?

Overheating guidance and tools for building designers

A number of cool guides to help with the heat.

The UK's Modern Industrial Strategy: A 10 year plan

Previous consultation criticism, current key elements and general support with some persisting reservations.

Building Safety Regulator reforms

New roles, new staff and a new fast track service pave the way for a single construction regulator.

Architectural Technologist CPDs and Communications

CIAT CPD… and how you can do it!

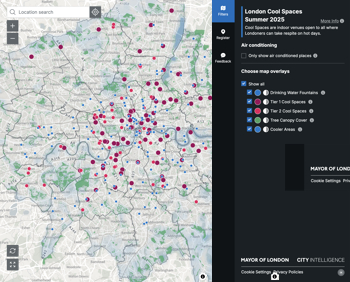

Cooling centres and cool spaces

Managing extreme heat in cities by directing the public to places for heat stress relief and water sources.

Winter gardens: A brief history and warm variations

Extending the season with glass in different forms and terms.

Restoring Great Yarmouth's Winter Gardens

Transforming one of the least sustainable constructions imaginable.